maine excise tax rates

2020 -- 1350 per 1000 of value. Maine Aviation Fuel Tax In Maine Aviation Fuel is subject to a state excise tax of.

Excise Tax Information Cumberland Me

Watercraft Excise Rate Chart.

. 2022 -- 2400 per 1000 of value. The rates drop back on January 1st each year. Watercraft Excise Tax Rate Table.

Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. 2022 Watercraft Excise Tax Payment Form. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax.

The excise tax due will be 61080 A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. How is the excise tax calculated. This calculator is for the renewal registrations of passenger vehicles only.

Maine calculates this tax by taking the current MSRP of your vehicle and multiplying it by the mileage rate. 18 rows Commercial Forestry Excise Tax. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehiclePlease note this is only for estimation purposes the exact cost will.

Use this tool to compare the state income taxes in Maine and Massachusetts or any other pair of states. HOW IS THE EXCISE TAX CALCULATED. 2721 - 2726.

Excise Tax is an annual tax that must be paid when you are registering a vehicle. The primary excise taxes on fuel in Maine are on gasoline though most states also tax other types of fuel. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below.

AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. How much will it cost to renew my. The rates drop back on January 1st of each year.

2021 -- 1750 per 1000 of value. To calculate your estimated registration. YEAR 1 0240 mil rate YEAR 2 0175 mil.

This tool compares the tax brackets for single individuals in each state. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown to the right. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

As of August 2014 mil rates are as follows. Maine Watercraft Excise Tax Law - Title 36. 1 City Hall Plaza Ellsworth ME 04605.

Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. Share this Page How much will it cost to renew my registration. Over 155 sold through state.

YEAR 1 0240 mill rate. Visit the Maine Revenue Service page for updated mil rates. Calculation will be based on.

16 rows Effective July 1 2009 the full gasoline excise tax rate is imposed on internal combustion. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. The excise tax is calculated by multiplying the MSRP of the vehicle by the corresponding years mil rate shown below.

For example a two year old car with a MSRP of. Contact 207283-3303 with any questions regarding the excise tax calculator. Departments Treasury Motor Vehicles Excise Tax Calculator.

For example if your vehicle has an MSRP of 8950 and a. In Maine wine vendors are responsible for paying a state excise tax of 060 per gallon plus Federal excise taxes for all wine sold. 2019 -- 1000 per 1000 of value.

11 hours agoCalifornia levies a 15 percent excise tax on wholesale rates along with taxes of 965 per ounce on marijuana flowers 287 per ounce on leaves and 135 per ounce of fresh. MSRP manufacturers suggested retail price HOW IS THE EXCISE TAX CALCULATED. Monday-Friday 8AM to 5PM.

Individual Income Tax 1040ME Corporate Income Tax 1120ME Estate Tax 706ME Franchise Tax 1120B-ME Fiduciary Income Tax 1041ME Insurance Tax. Boat Launch Season Pass - Piscataqua River Boat Basin. Mil rate is the rate used to calculate excise tax.

Transfer Tax Calculator 2022 For All 50 States

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Car Tax By State Usa Manual Car Sales Tax Calculator

Figure 10 State Cigarette Excise Tax Rates By Pack In 201 Flickr

Which U S States Charge Property Taxes For Cars Mansion Global

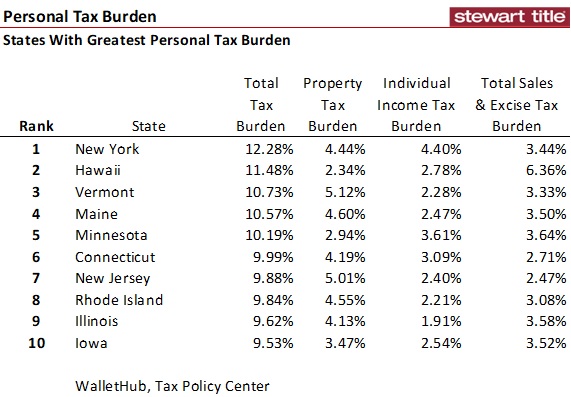

Home Insights Stewart Title Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Maine Sales Tax On Cars Everything You Need To Know

State Alcohol Excise Tax Rates Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Ultimate Excise Tax Guide Definition Examples State Vs Federal

Excise Tax What It Is How It S Calculated

U S States With Highest Gas Tax 2022 Statista

Upsssc Cane Supervisor Result 2019 Languages Questions Supervisor Merit